You may have

got yourself into

trouble but we can

help you out

How focusing on the right solutions can help us, help you

Apply in minutes With Our Lending Partner CashPal

Click here to be directed to CashPal ️

Moving from the problem

to the solution

One of the many things that can cause hesitation, trepidation and general stress when thinking about securing funds for any kind of cash loan, is the potential questions around how it all came to this. How did I get myself in a position where it seems I’m out of cash and out of options? Where did I go wrong? These questions, while important for the purpose of ensuring there isn’t a repeat of the incidents that got you here, can often stop you from figuring out a solution. In turn, that potentially delays your first and very important steps towards resolving the situation at hand - accessing some fast cash.

There is still a way to get on top

Now the good news is that there are lenders out there that are not all that concerned about exactly how you landed in the situation you’re in, they’re more concerned about how much cash you need to borrow to get you out of it / on top of it / through it

Understanding your situation

Whether it was an ill-advised purchase, a disaster at home that blindsided you, a sudden and unexpected change to your employment situation or you’ve come to find that you’re simply bad with money (but taking steps to remedy that), it’s easy to feel a bit embarrassed about your circumstances.

How much money do I need to resolve my current situation or meet my immediate needs?

Think about the total cost of the repair, or the purchase or the funds required for whatever it is you need

What is my total earning capacity & what are the living expenses I need to service?

This gives you a good idea of the repayments you will be able to manage

What prospects do I have in my immediate to medium term future?

Think about your employment situation, additional income (including passive income)

How quickly do I need this cash loan?

Again, this may be affected by the nature of your need - emergency repairs to plumbing or electricity at home, opportunity for a rare or important purchase, any kind of time-sensitive acquisition... vs longer term planned investments, wants or opportunities

Nevermind “how”,

let’s talk “how much?”

What’s happened has happen and most of us can accept that there’s nothing much you can do to change what’s been done in the past. The future? That’s a different story and in order to write the next chapter of your story, you’re going to have to shift your thinking into solution mode.

That means giving some serious consideration to these 4 questions:

Moving from the problem

to the solution

One of the many things that can cause hesitation, trepidation and general stress when thinking about securing funds for any kind of cash loan, is the potential questions around how it all came to this. How did I get myself in a position where it seems I’m out of cash and out of options? Where did I go wrong? These questions, while important for the purpose of ensuring there isn’t a repeat of the incidents that got you here, can often stop you from figuring out a solution. In turn, that potentially delays your first and very important steps towards resolving the situation at hand - accessing some fast cash.

Identifying the right lender

So, where are they, who do I call, how do I identify and skip over the lenders that need to know every single detail along my path to getting here, and find the ones that just want to help? In other words, if you don’t have days but only hours to find the right lender, how do you find the ones that will simply say “how much” instead of “how, exactly, did you get into this mess?”

The answer is: find a broker that can fix you

It’s a rather simple answer to a range of potentially complicated questions. Time is of the essence, you don’t have all week or even all day but happily, there are businesses whose business it is to find a broker that can find you a lender quickly. Again, we come back to the issue of finding the right one.

That means giving some serious consideration to these 3 questions:

Who has access to a wide range of lenders?

By wide range we mean wide range of lenders and loans. Undoubtedly, there are those that specialise in home loans, business loans, personal loans... but is that what you’re after? If not, that may be a dead end for you.

Who has a system in place that is both secure & seamless, where you’re kept in the loop & communicated with promptly?

It’s the sitting around and waiting for answers and the convoluted processes that really wears you down so avoid those scenarios

Who de-prioritises the why behind the what and focuses on what you need now rather than what happened in the past?

Yes, the past has a bearing on the future but you want a broker than can get things moving and keep things moving. Remember, time is often of the essence.

.png)

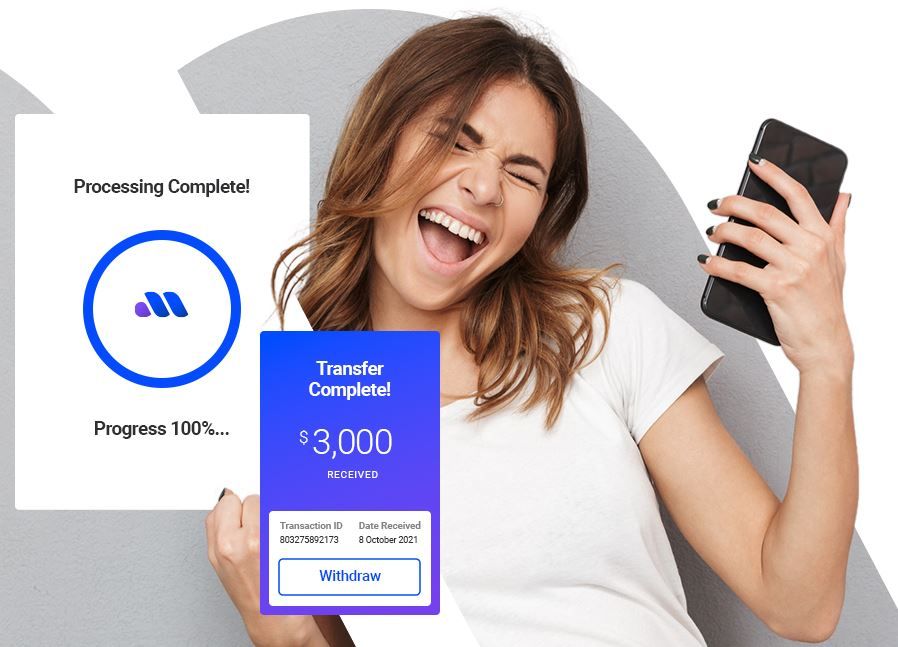

A Fast, Efficient & Effective Solution

Needing to access fast cash via a quick loan can be stressful however, there are solutions out that can minimise the stress and focus on the solution, not the problem - which is usually half the battle. At MeLoan we understand this and work solely to quickly and efficiently connect you to the best lender option for you.